Elon Musk Moves xAI Into SpaceX as Power Becomes the Binding Constraint on Artificial Intelligence

SpaceX has acquired Elon Musk’s artificial intelligence company xAI, consolidating two of his largest private ventures into a single corporate structure at a reported combined valuation of around 1.25 trillion dollars. The transaction is being framed not just as a corporate consolidation, but as a response to a deeper constraint now shaping the future of artificial intelligence: power.

The reported transaction

If confirmed as reported, the deal would rank among the largest private company consolidations ever undertaken. It also comes amid renewed discussion of a potential SpaceX initial public offering, which would, if pursued, represent one of the largest market listings in history.

The consolidation builds on a pattern already visible across Musk’s ventures. xAI had previously been integrated with the social media platform X, allowing its models to be trained on live platform data and embedded directly into user facing products. Folding xAI into SpaceX would extend that integration further, bringing artificial intelligence development into the same corporate orbit as satellite infrastructure, launch capability and global communications networks.

Transaction structure and valuation. The transaction has been reported at a combined valuation of approximately 1.25 trillion dollars, with SpaceX valued at around 1 trillion dollars and xAI at roughly 250 billion dollars. Under the reported exchange mechanics, xAI shareholders receive 0.1433 shares of SpaceX stock for each xAI share, equivalent to roughly one SpaceX share for every seven xAI shares, with some executives able to elect a limited cash payout.

At first glance, the transaction resembles a founder tidying up his corporate structure ahead of a possible listing. But the rationale being advanced for the deal goes beyond valuation optics. It rests on a claim about physical limits, specifically the amount of power that advanced artificial intelligence systems will require in the years ahead, and where that power can realistically come from.

Why this story matters. This story is not primarily about rockets or software. It is about energy and constraint. Modern AI systems consume large and growing quantities of electricity, and that demand is colliding with slow moving grids, planning systems and political resistance.

The SpaceX xAI consolidation matters because it frames that collision as an engineering problem that can be escaped rather than a political problem that must be managed. If that framing holds, it has implications not just for one company, but for how future infrastructure, capital and regulation interact.

Valuation, IPOs and what investors are being asked to accept

Much of the surrounding commentary has focused on valuation and timing. Some reporting has suggested that SpaceX is considering an initial public offering later this year and has linked that possibility to unusual narrative colour, including references to astronomical events. These claims originate from attributed reporting and unnamed sources, and no public filing, interview or attributable statement establishes such factors as drivers of corporate or capital markets decision making.

Any such references should therefore be read as narrative colour rather than as evidence of strategy.

Why the IPO and valuation are significant. The reported valuation is significant not only for its size, but for what it assumes. It prices a private company as if future constraints have already been resolved, including energy, regulation, infrastructure and scale.

An eventual IPO would not merely raise capital. It would invite public markets to endorse a narrative in which AI growth continues uninterrupted, and in which energy supply expands to meet it.

The real constraint power not algorithms

What is clear is the strategic rationale being advanced for the merger. Artificial intelligence has become increasingly constrained not by algorithms alone, but by physical inputs, including compute, capital and power. The cost of training and running large models has escalated sharply, and energy consumption has moved from a background consideration to a central bottleneck.

Electricity demand from data centres is rising rapidly, with AI now the dominant driver of growth. The International Energy Agency estimates that global data centres consumed roughly 415 terawatt hours of electricity in 2024, about 1.5 per cent of global demand, and projects that consumption could more than double by 2030 as AI workloads expand.

What the energy problem actually is. The problem AI faces is not that the world is running out of electricity. The problem is where power is generated, how quickly it can be delivered, and who decides.

AI data centres concentrate demand in specific locations, and they arrive faster than transmission lines, permits and political consensus.

Where pressure becomes acute is therefore not at the level of global energy availability, but at the level of local grids. Reliability authorities warn that large AI data centres are arriving faster than generation and transmission infrastructure can be permitted and built, creating concentrated strain in specific regions rather than a systemic shortage of power.

Space based computing as a proposed escape

It is against this backdrop that Musk has argued that the long term scaling of AI will require moving compute into orbit, where satellites can draw on continuous solar power. The idea of orbital data centres has been presented as a way to bypass terrestrial constraints, from grid congestion to community opposition.

However, this remains a statement of strategic vision rather than an established engineering solution. No detailed technical programme, costed architecture or regulatory pathway has been published to demonstrate how space based computing could operate at meaningful scale.

Why space based power is being invoked. Space based computing offers an appealing idea, energy without local opposition, planning delays or grid congestion.

In practice, no operational system of this kind has been demonstrated at scale.

China fusion and the long horizon

Similar caution applies to nuclear fusion, which has increasingly been drawn into the AI energy narrative. China has made real and measurable progress in fusion research, including sustaining high confinement plasma for more than one thousand seconds and advancing reactor scale engineering studies.

What these achievements do not yet demonstrate is net electricity production, a closed fuel cycle or commercial durability. Fusion remains a long term prospect.

What China’s fusion progress does and does not mean. China has demonstrated seriousness, scale and technical competence. It has not demonstrated a power plant.

Fusion cannot relieve the energy pressures now emerging from AI growth.

The conclusion plainly stated

Seen together, fusion and space based computing serve a similar role in the SpaceX xAI narrative. Both function as placeholders for a future energy regime in which today’s constraints appear to dissolve. Neither alters the operational reality now governing AI deployment, which remains bound by terrestrial power systems, regulatory timelines and local grid capacity.

The conclusion plainly stated. The consolidation signals confidence in a future where energy constraints are assumed away, even as present deployment remains limited by infrastructure that cannot be bypassed on demand.

Taken together, the consolidation of SpaceX and xAI should therefore be read as a financial event with a strategic audience. It speaks to investors, regulators and governments in the language of future engineering promise, while leaving unresolved the nearer term question of how rapidly expanding AI systems are powered, permitted and absorbed into existing grids.

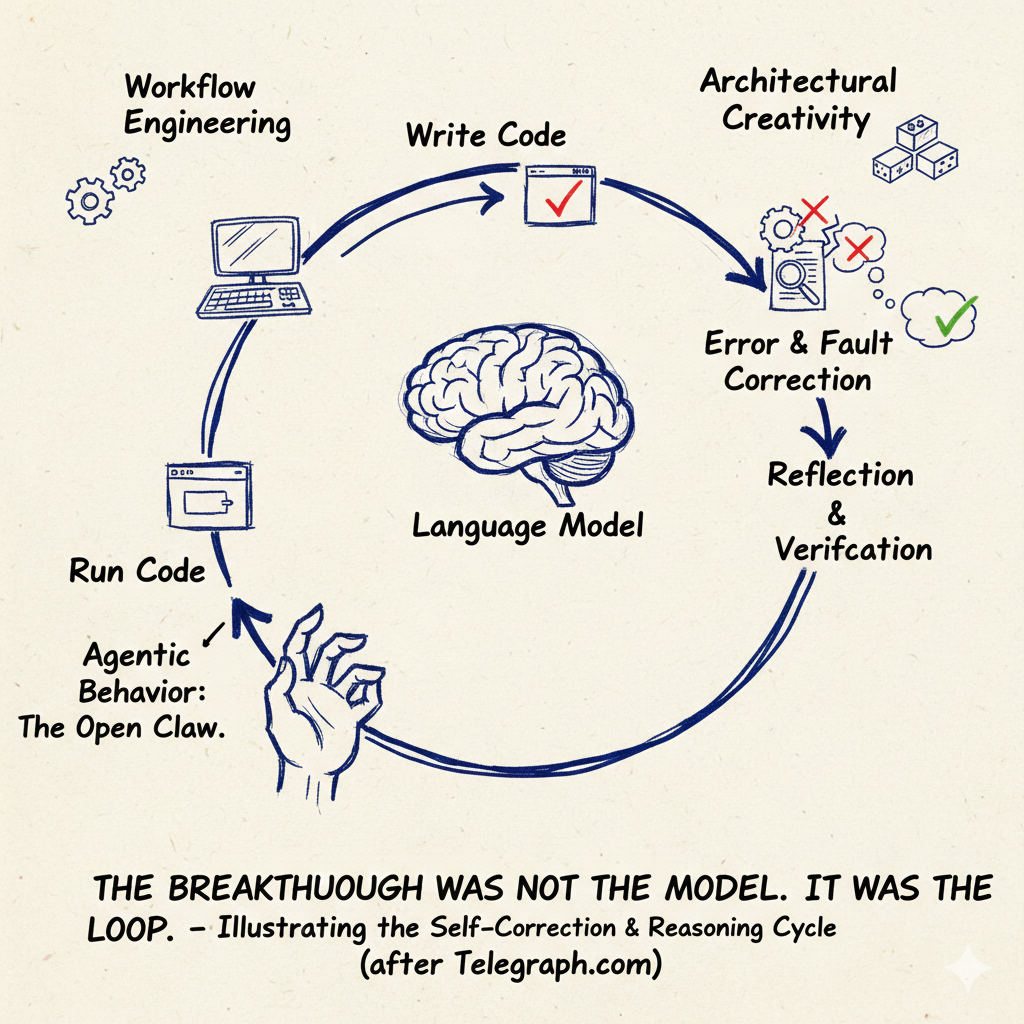

You might also like to read on Telegraph.com

The Real AI Arms Race Is Energy, Not Silicon

Why the decisive bottleneck in AI is electricity and grid capacity, not just chips and export controls.

London Leads Europe in AI, but Without Power and Capital

Britain has talent and firms, but lacks the grid, land and capital base to scale frontier AI at speed.

The AI Boom Without Exit: Mania, Markets, and the Madness of Crowds

A look at the investment binge behind generative AI and the risks of building infrastructure without profits.

Marx in the Machine Room: The Material Truth Behind AI’s Power

AI as material power: data centres, electricity contracts, ownership and the industrial order beneath the rhetoric.

The Forge of China’s Self Reliance

How export pressure on semiconductors was repurposed into a long term industrial strategy and domestic substitution push.

China’s Chip Progress and the Evidence Gap

Separating what can be established from what is allegation in claims about Chinese workarounds and advanced nodes.

China Is Not Building Ports Now It Is Building the Rules

Why standards, protocols and tech governance are becoming the new sovereignty layer of global power.

When the Sky Went Online: How Starlink Undermined Iran’s Internet Blackout

A systems view of censorship, satellites and countermeasures, and how connectivity now moves from cables to spectrum.