The AI Boom Without Exit: Mania, Markets, and the Madness of Crowds

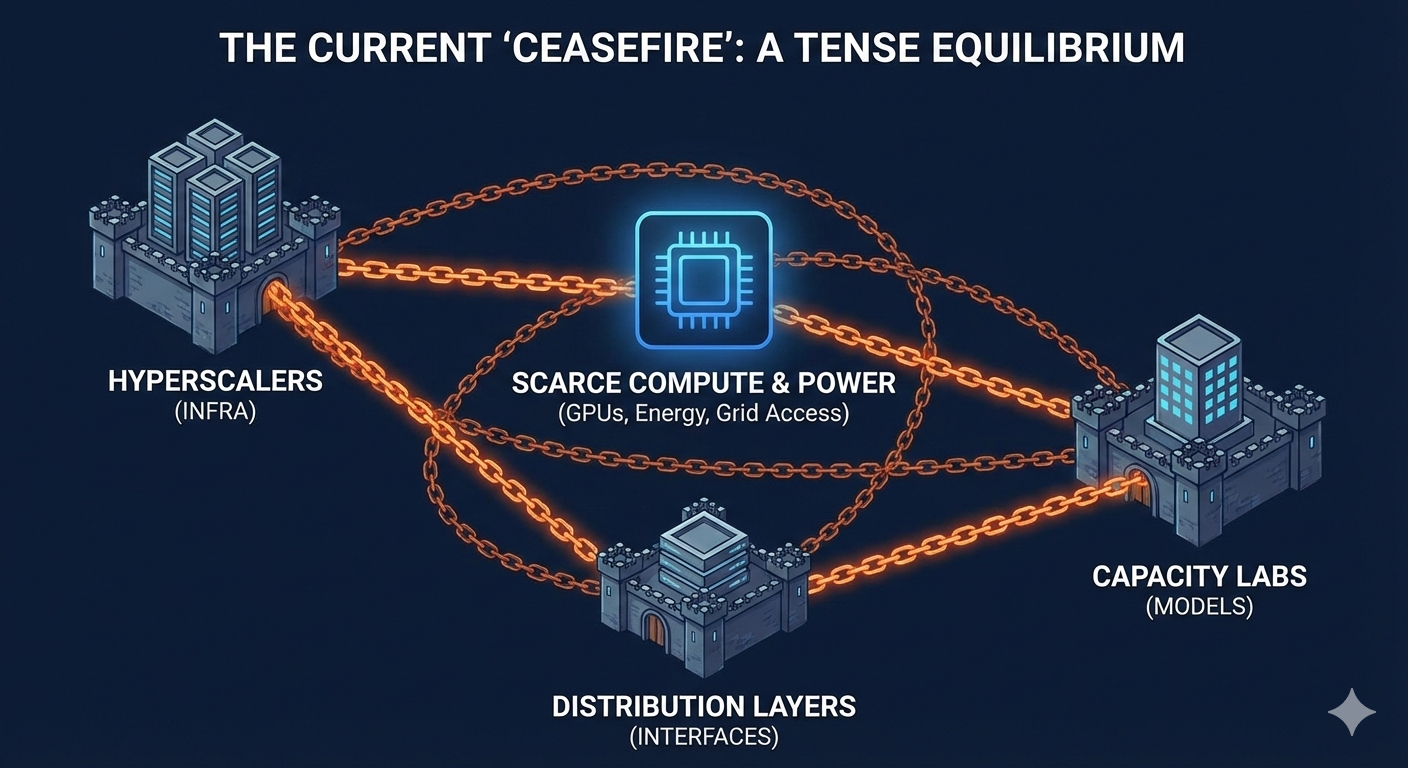

The Artificial Intelligence mania has dressed itself in the language of inevitability. We are told this is the new railroads, the new internet, the new electricity. But look closer at the economics and you see something else entirely: a liquidity treadmill in which four companies—Microsoft, Amazon, Google, and Meta—burn money through leased data centers to keep generative AI humming, while revenues limp far behind costs. This is not an industry; it is an infrastructure sinkhole.

The Oracle–OpenAI Fantasy Contract

The most spectacular example of this self-delusion is the $300 billion contract OpenAI has signed with Oracle. Spread over five years, the deal would require $60 billion a year in payments—six times OpenAI’s current revenues. The contract will consume 4.5 gigawatts of electricity, equivalent to two Hoover Dams, or four million homes.

The numbers don’t add up. Oracle will need to borrow heavily to buy chips it cannot afford, while OpenAI itself admits it will not be profitable until 2029 and expects to lose $44 billion before then. Yet the mere announcement of this “future revenue” was enough to push Oracle’s stock up 43% and inflate Larry Ellison’s fortune by $100 billion. A paper contract with a money-losing startup was treated as if it were real cash. That is how bubbles are built.

Outsourcing the Risk, Leasing the Illusion

The railroad barons of the 19th century laid steel across the Rockies and owned the rails they laid. They shouldered the capital risk in exchange for controlling the arteries of commerce. Today’s tech giants refuse to do even that. They contract third parties to build the physical data centers and then lease them back, outsourcing the risk while keeping only the marketing narrative.

This is not ownership. It is rental dressed up as revolution.

Generative AI requires staggering quantities of physical infrastructure, yet none of the “Magnificent Seven” want to tie their balance sheets to depreciating server barns. They know these warehouses of GPUs age quickly, becoming worthless in three years. So they leave the risk to contractors, landlords, and municipal ratepayers, while they skim market capitalisation gains off the hype.

The Grid as Collateral Damage

The price is not just financial. Data centers already consume four percent of U.S. electricity. By 2028, the Department of Energy expects that figure to triple to twelve percent. The existing grid—built in the 1950s to handle modest suburban traffic—has become a two-lane highway jammed with rush-hour trucks. Transmission lines overheat. Congestion forces utilities to dispatch costlier, dirtier power.

And who pays for the upgrades? Not Microsoft. Not OpenAI. Municipal customers. The public subsidises the hype, footing the bill for new transmission lines and higher rates while Silicon Valley congratulates itself on its “green AI future.”

No Profits, No Exits

The deeper contradiction is this: generative AI does not make money. It never has. Chatbots and copilots earn scraps compared to the billions sunk into infrastructure. Cursor, a coding tool built on Anthropic’s models, is valued at ten billion dollars. Nobody wants to buy it. OpenAI itself, last pegged at five hundred billion, is too bloated to IPO and too fantastical to be acquired.

There are no exits. Venture firms cannot cash out. The only liquidity in this ecosystem comes from private rounds at ever-higher paper valuations, sustained not by revenue but by self-delusion.

Learning Nothing from History

At least the dot-com bubble left us fibre-optic cables. At least railway mania left steel tracks. Even the housing bubble left houses. When the AI boom deflates, what remains? Warehouses stuffed with obsolete GPUs. Empty shells that once burned enough electricity to power four million homes. The sunk cost will not be a national asset but a national liability—grid distortions, municipal debt, and stranded infrastructure.

We have seen this before: manias that promised transformation, only to leave wreckage. But this time the promises are tethered not to software or finance, but to physical energy demands the grid cannot bear and financial valuations no investor can redeem.

The Peak of Delusion

This is the unnatural economy of AI: all costs, no profits, and no exits. It survives by exporting risk to contractors, municipalities, and retail investors, while insiders cash out on inflated valuations. It is a system designed not to deliver value but to externalise damage.

The railroad barons left steel in the ground. The dot-coms left fibre in the soil. The AI titans will leave only scorched grids, empty warehouses, and venture firms with no way out.

When the music stops, the wreckage will be ours.

Funny how every cycle looks the same. They call it “investment,” but it’s really just casino chips stacked higher each time. Now it’s AI — lst year it was crypto, before housing, before that dot-coms.

What’s new is the way retirement savings get siphoned in auto, dressed up as longterm growth. Workers feeding the machine with their pensions, BlackRock and Vanguard skim the cream, and the money is leveragedinto whatever the current bubble happens to be.

When it all blows up, ordinary people will lose twice: once in their savings, and again when they’re taxed to patch up the wreckage for the wealthy. It’s the neattest trick capitalism ever pulled — heads they win, tails you lose.