The Compute Détente: Why Big Tech Is Buying Everyone and Why It Will Not Last

The tangle of AI cross investments now linking Amazon, Microsoft, Google, and the frontier labs is not collaboration. It is a temporary ceasefire imposed by compute scarcity. And like all ceasefires under material pressure, it is already fraying.

The current AI investment landscape looks, at first glance, absurd. Amazon is exploring a vast investment in OpenAI while remaining deeply tied to Anthropic. Microsoft has loosened its grip on OpenAI while committing to historic levels of Azure spending. Anthropic, nominally anchored to AWS, is scaling aggressively on Google infrastructure. Nvidia sits in the middle of all of it, selling picks and shovels to every side.

Read casually, it looks like confusion. Read politically, it looks like circular capital flows. Read correctly, it looks like something else entirely.

This is not a story about alliances breaking down. It is a story about physical limits closing in.

The Illusion of Chaos

The mistake most observers make is to treat these moves as expressions of preference or strategy in the abstract. They are not. They are reactions to scarcity.

Capital is abundant. Compute is not.

Amazon interest in OpenAI does not signal a loss of faith in Anthropic. OpenAI retreat from Azure exclusivity does not signal a rupture with Microsoft. These are not ideological pivots or relationship dramas. They are defensive manoeuvres in a system where being locked into a single supplier has become a structural risk.

The question is not who prefers whom. The question is who can guarantee capacity when it is needed, and on what terms.

Compute, Not Capital

At the frontier, money no longer buys safety. Compute does.

A billion dollars of unrestricted capital is less valuable than assured access to GPUs, power, cooling, and interconnect at the moment a training run must execute. That is why so many investments in AI labs look strange when judged by venture capital norms. They are not venture investments. They are capacity reservations, dressed up to look like equity.

This is not theoretical. Hyperscalers already use cloud credits as financial instruments. At larger scales, the same logic applies with heavier machinery: long dated supply agreements, priority access clauses, chip alignment, and infrastructure commitments.

The constraint is now physical. Data centres are bottlenecked by grid access, transformer supply, permitting delays, and local resistance. Power has become the binding limit. Compute follows power. Everything else follows compute.

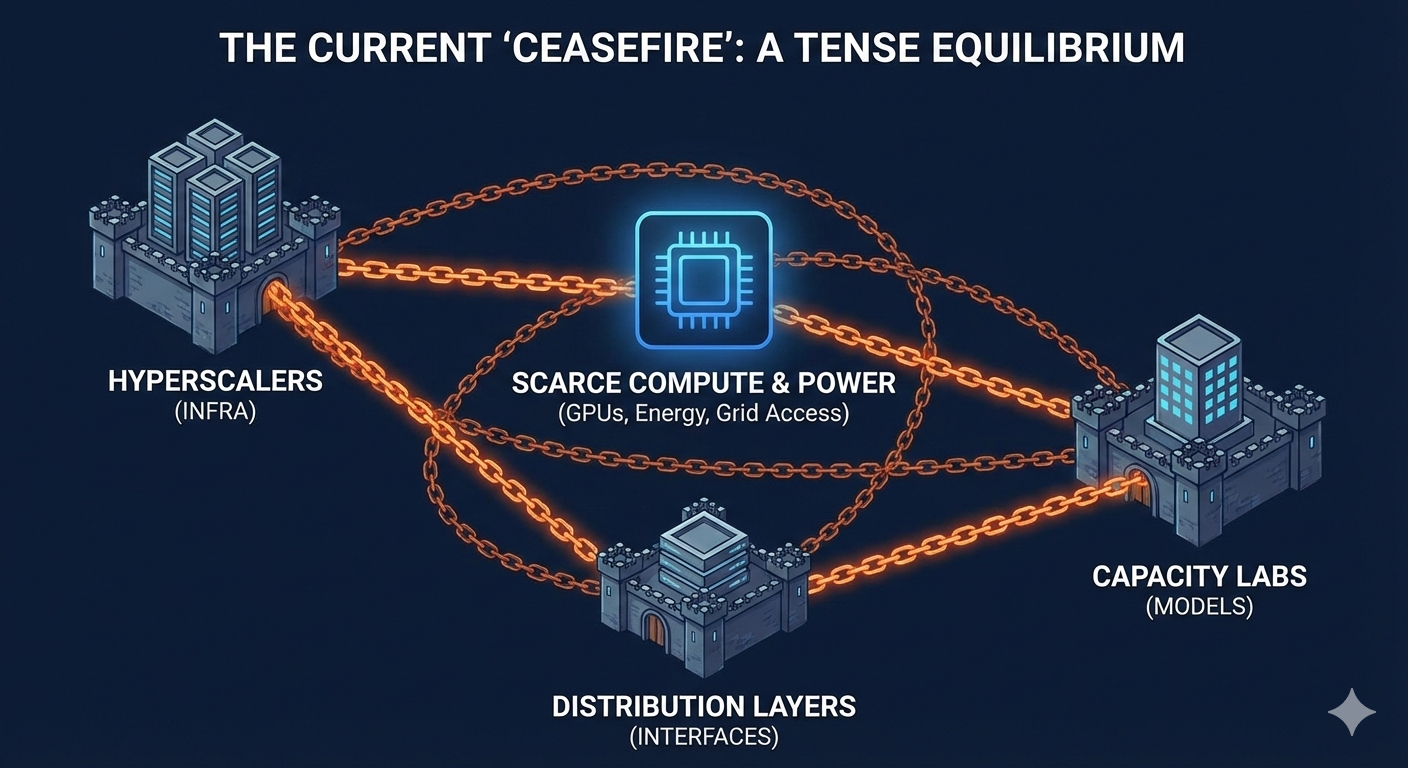

Illustration showing the convergence of AI labs, hyperscalers, and compute infrastructure.

A Three Sided Standoff

The industry has settled into a temporary equilibrium involving three actors.

Hyperscalers control data centres, chips, power procurement, and enterprise distribution. Frontier labs control model capability and research velocity. Distribution layers control the interfaces through which intelligence is consumed.

Each fears capture by the others. Labs fear being trapped inside a single cloud pricing and allocation regime. Hyperscalers fear models becoming portable commodities that route around their platforms. Distribution owners fear being bypassed by agentic systems that collapse interfaces altogether.

The result is a carefully managed détente. Hard exclusivity gives way to softer language. Rights of first refusal are diluted. Escape clauses multiply. Multi cloud becomes a necessity rather than a branding exercise.

This is not instability. It is crisis management.

What These Deals Really Do

Strip away the press releases and the structures repeat.

Equity stakes are often convertible or non voting. Compute supply is long dated and prioritised. Models are optimised for specific silicon stacks. Distribution is embedded through managed services and marketplaces. Exclusivity is replaced with carve outs. Intellectual property and integration rights are locked in well beyond the lifespan of the public partnership.

Regulators and corporate disclosures now make this explicit. These arrangements are industrial contracts, not expressions of faith. They exist to allocate scarce resources and preserve leverage under stress.

Once this is understood, the headlines become easier to read, and less reassuring.

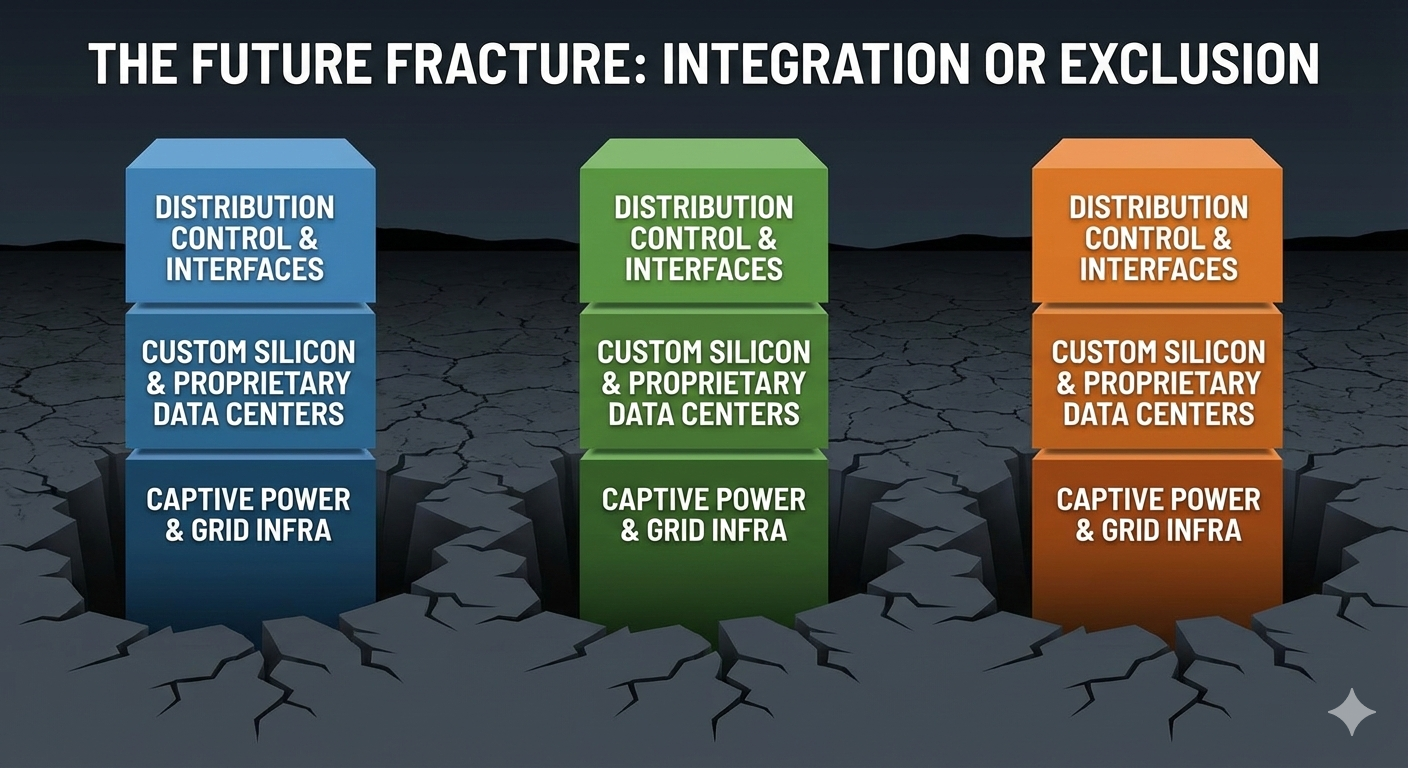

Illustration highlighting the relationship between compute capacity, power infrastructure, and AI platform consolidation.

Where This Leads

The current web of cross investment exists because scarcity is severe but not yet absolute. It buys time. It does not change the destination.

As constraints harden, trust gives way to ownership. Vertical integration reasserts itself. Custom silicon, captive power, proprietary data centres, and distribution control become non negotiable.

Some players move faster and more visibly than others. But the direction is uniform. The system fractures not through drama, but through physics: power limits, grid politics, and supply denial.

Those furthest along this path are not anomalies. They are previews.

The Cost of Exclusion

The consequences extend well beyond Silicon Valley.

Regions that cannot build power and grid infrastructure fall behind regardless of talent. Compute becomes a reserved commodity, sold wholesale to insiders and retail to everyone else. Interfaces turn into toll booths. Independent software collapses into platforms.

The labour market absorbs the shock unevenly. Routine cognitive work disappears first. Entry level roles vanish. Institutions optimise for output and hollow out their own future expertise.

None of this requires conspiracy. It follows directly from constraint and incentive.

Conclusion

What looks like a circular AI economy is, in reality, a selective one. Cross investment is not a sign of harmony. It is a symptom of stress.

The AI economy is converging on a small number of vertically integrated stacks because only such structures can survive sustained scarcity in compute and power. Everyone else becomes downstream.

This will not look like a war. It will look like normal business.

And it will be just as decisive.

You might also like to read on Telegraph.com

Explore our recent reporting and analysis on artificial intelligence, including coverage of AI infrastructure, compute constraints, frontier models, and the economic and political consequences of rapid AI deployment.

View the artificial intelligence collection.