The Exit Ramp: How Countries Are Reducing Their Dependence on the Dollar

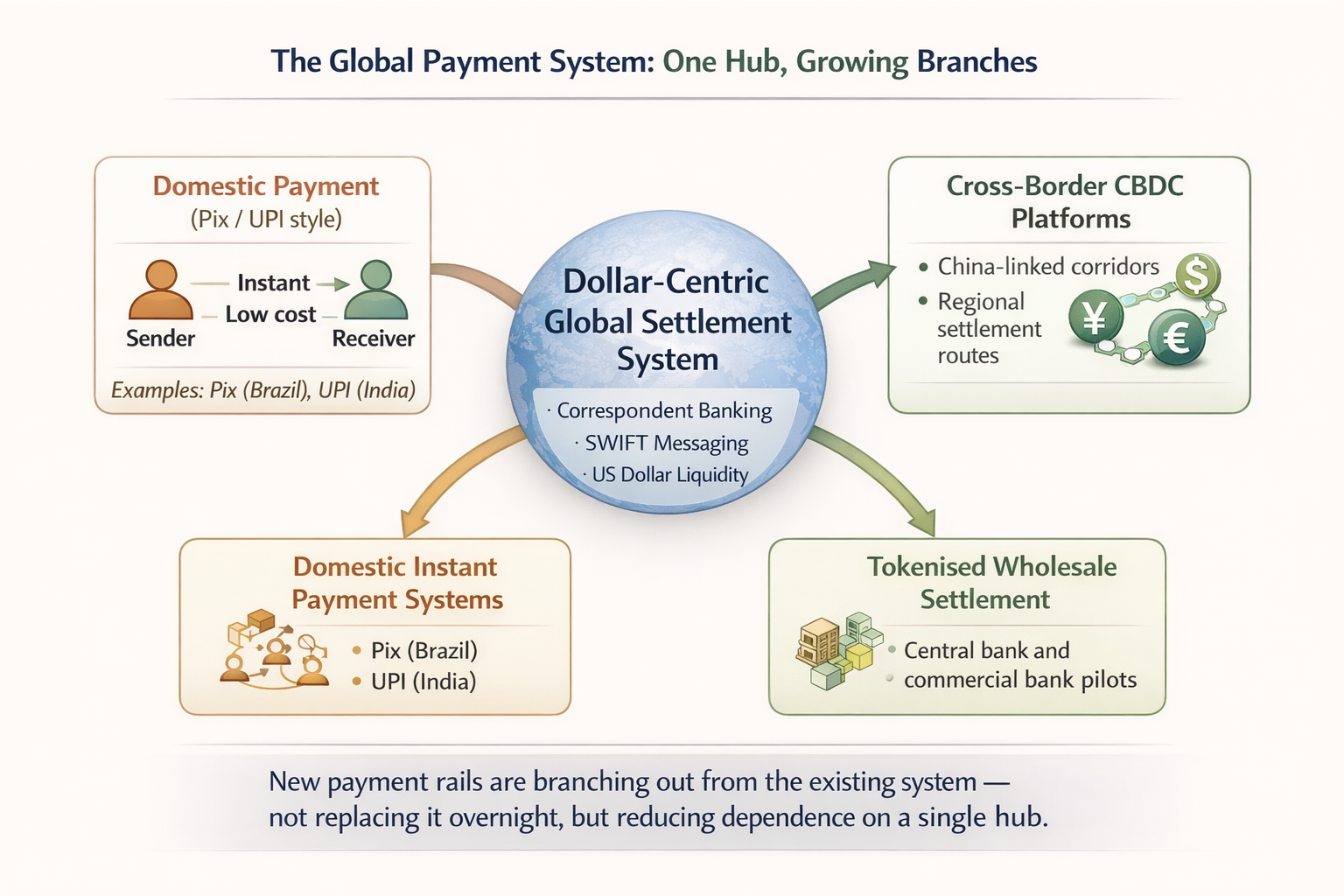

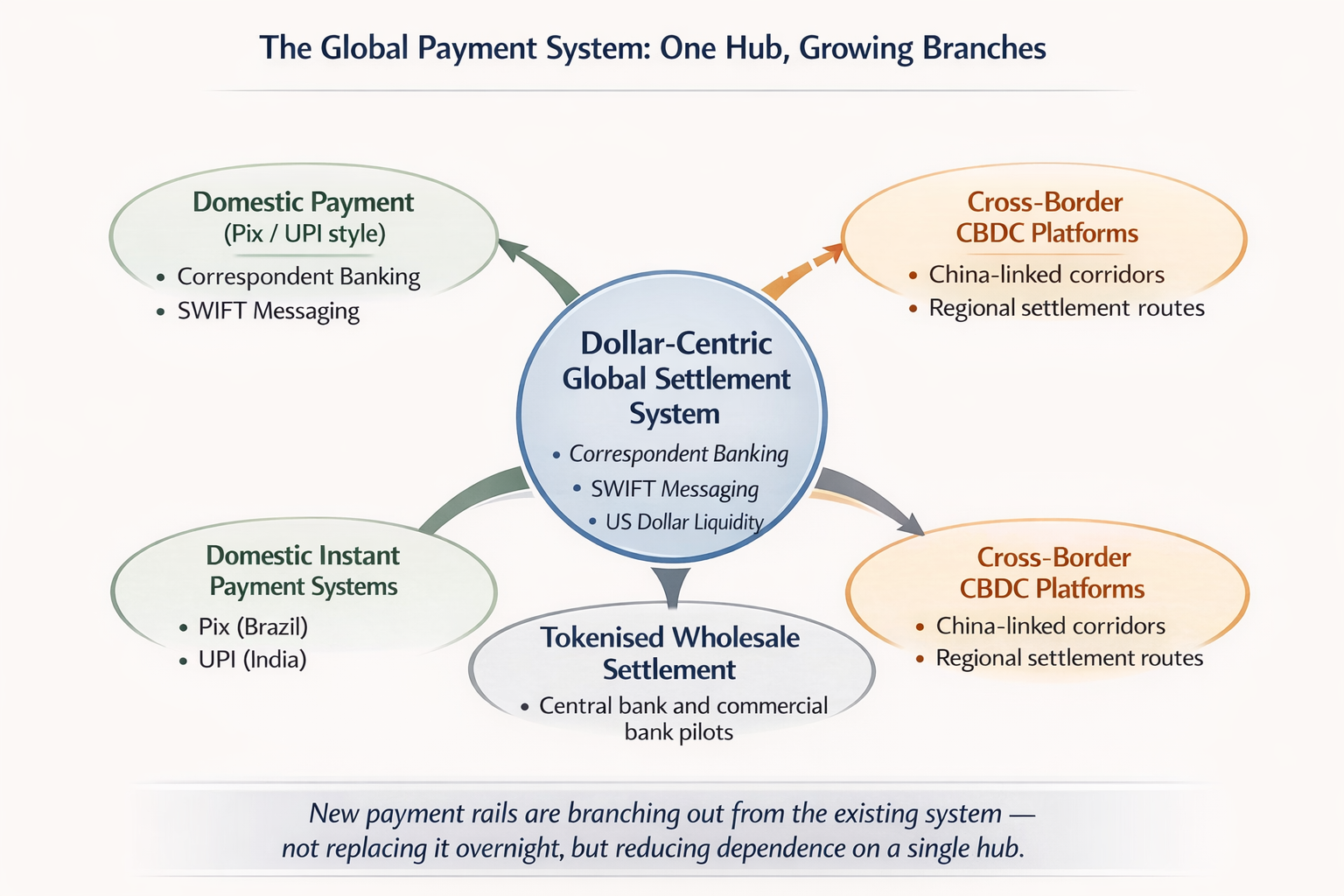

The dollar still dominates global finance, but states are no longer willing to rely on a single set of routes. From instant domestic payments to new cross border settlement systems, a parallel infrastructure is taking shape less about overthrowing the dollar than about surviving without it.

Most people think of money as neutral. You earn it, you spend it, it moves. But for states, money is never just money. It is infrastructure. It is custody. It is power.

The dollar as infrastructure

For decades, the United States dollar has functioned as the operating system of global trade. By operating system I mean the default layer that everything else quietly runs on. Energy contracts are priced in dollars. Shipping insurance is written in dollars. Banks settle through dollar correspondent accounts. Even transactions between two non American countries often pass, invisibly, through American controlled pathways.

This dominance is not maintained by force alone. It persists because it works. The dollar sits on the deepest capital markets in the world. Its assets are liquid, abundant, and trusted. But convenience has a cost, and that cost is exposure.

When US interest rates rise, borrowing costs tighten far beyond America’s borders. When rules change in Washington, entire trade corridors feel the effect. And when geopolitics hardens, access to the system itself can be restricted.

Key idea: Dollar dominance is not just about currency choice. It is about infrastructure control payments, settlement, custody, and messaging.

Why a new currency was never the point

This reality explains a persistent misunderstanding. The world is not trying to replace the dollar with a new global currency. That would require shared fiscal discipline, aligned inflation policy, and a central authority capable of overrulling national politics. Even among similar economies, that is difficult. Among large, diverse states, it is unrealistic.

What is being built instead is more modest and more viable. Not a new currency, but alternative pathways. By pathways I mean practical routes for money to move that reduce reliance on a single system. Ways of moving existing sovereign money more efficiently, with fewer choke points.

The friction problem

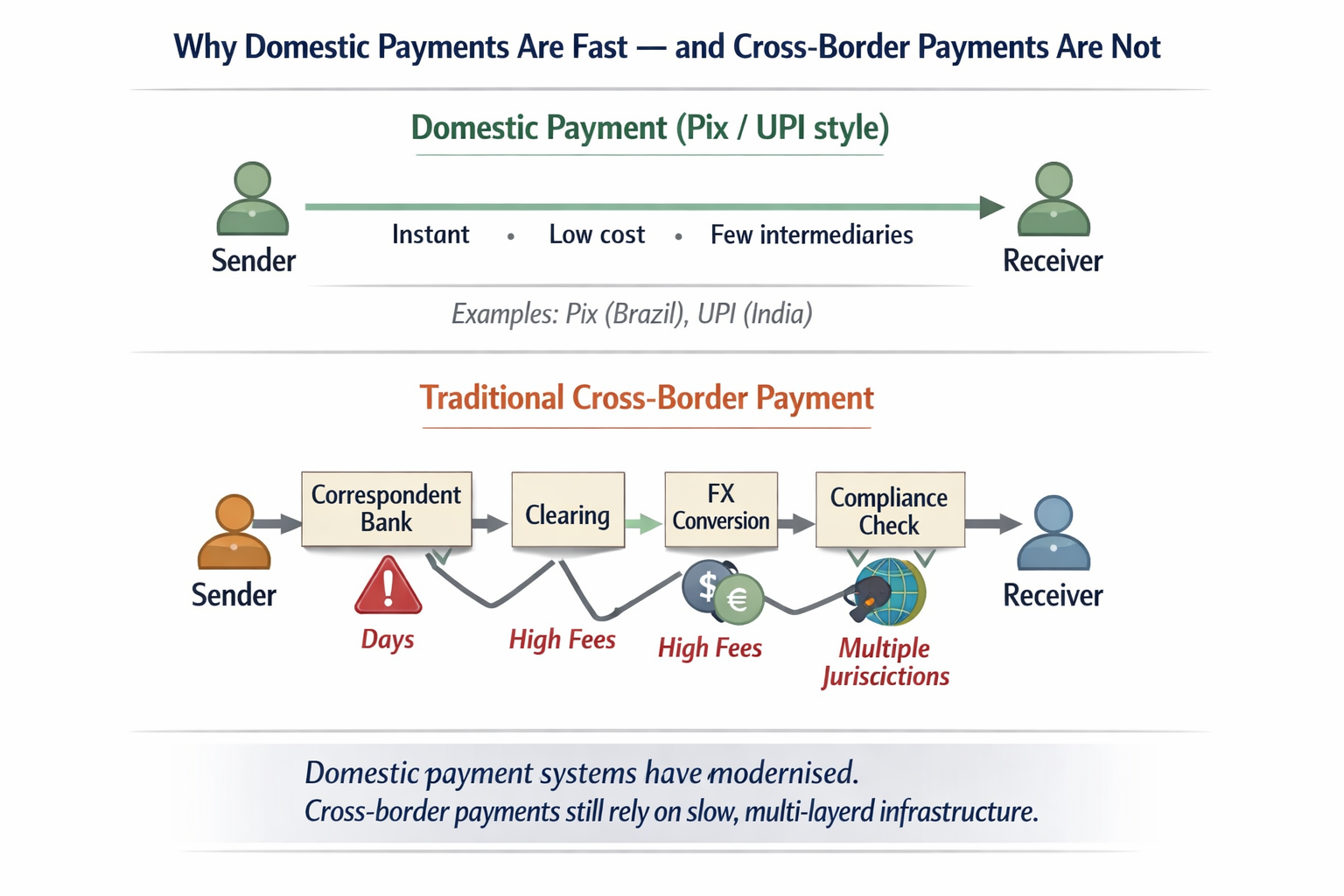

The motivation is not ideological. It is practical. Cross border payments remain slow and expensive, even as domestic payments have become instant. Businesses must hold excess liquidity just to manage delays. Fees compound as transactions move through layers of intermediaries. This inefficiency existed long before it became geopolitical.

Brazil’s Pix and payment sovereignty

Nowhere is the alternative clearer than in Brazil.

Brazil’s central bank built Pix, an instant payment system that allows money to move in real time at negligible cost. Adoption was rapid. Pix quickly overtook cards and bank transfers, reshaping everyday commerce.

The significance of Pix is structural. When payments are treated as public infrastructure rather than a private add on, the entire economy shifts. Small businesses face lower fees. Informal users enter formal pathways. Innovation builds on top of the platform.

Domestic payment systems such as Brazil’s Pix and India’s UPI have modernised rapidly, while cross border payments still rely on slow, multi layered infrastructure with higher costs and delays.

Brazil has since extended Pix into recurring payments, allowing subscriptions and bills to be authorised with a single consent. This opened digital commerce to millions who never had credit cards. Payment sovereignty, once an abstract idea, became visible in daily life.

From domestic success to cross border routes

The same logic now appears at the cross border level.

In recent years, cross border digital currency platforms have moved from experiment to operation. These systems allow central banks and large institutions to settle transactions directly in digital versions of sovereign currencies, bypassing traditional correspondent banking chains in specific corridors.

They do not replace the dollar globally. They do something more subtle. They make it optional where dependence carries cost or risk energy trade, regional commerce, government to government settlement.

Technically, the design is conservative. Payments are often settled on a net basis rather than transaction by transaction, reducing liquidity strain. Central banks support the system with swap lines standing arrangements that allow currencies to be exchanged temporarily in times of stress. These act as shock absorbers. By shock absorbers I mean stabilisers that prevent short term jolts from breaking the whole system, preventing short term imbalances from freezing trade.

Modernisation without surrender

Established powers have noticed. Western central banks and commercial banks are testing their own next generation settlement systems, focused on tokenised wholesale payments rather than retail digital cash. The aim is similar faster, cheaper, more reliable cross border settlement without losing the centre of gravity. By centre of gravity I mean the place where liquidity, trust, and default practices naturally concentrate.

New payment pathways are branching out from the existing dollar centric settlement system, not replacing it overnight but reducing dependence on a single global hub.

Gold as a signal not a solution

Gold often appears in this story, but quietly. Central banks have shown renewed interest in assets that do not depend on another state’s legal system. Gold has no issuer, no counterparty, and no switch that can be turned off remotely. Its appeal lies less in price than in custody.

This does not mean currencies are being abandoned. It means trust has conditions now.

What changes and what does not

What changes is optionality. States gain more ways to settle trade and manage risk without relying exclusively on one route. What does not change is the dollar’s central role. US markets remain deep. Dollar assets remain liquid. In moments of panic, capital still flows toward the centre.

A serious objection to this analysis is that the dollar’s dominance runs far deeper than trade invoicing or payment systems. Private financial markets are bound together by vast networks of dollar denominated activity, from bank lending to derivatives and foreign exchange swaps, where the dollar remains the indispensable unit of account and risk management. Unwinding this architecture would be prohibitively costly, and nothing described here changes that reality. But that is precisely the point. The emergence of alternative settlement pathways is not an attempt to dismantle the dollar’s central role in private finance. It is an effort by states to reduce their exposure at the margins to ensure that trade, energy flows, and official payments can continue even when access to the dominant system becomes uncertain or politically constrained.

The global financial system is not abandoning the dollar. It is building parallel settlement routes to reduce risk and increase resilience.

The quiet conclusion

The future is not a clean handover from one system to another. It is duplication. Parallel routes laid quietly alongside the main route. By parallel routes I mean practical alternatives that can carry transactions when the main channel is congested or constrained. In calm times, they matter little. In moments of stress, they determine who keeps moving.

That is how systems change. Not with declarations, but with infrastructure that becomes normal before anyone realises what has shifted.

You might also like to read on Telegraph.com

The Surplus Delusion and the Credit State

A critique of trade surplus morality plays that reframes the real engine of modern imbalance as credit creation, state leverage, and distorted price signals.

What Drives Inflation Now: A Clear Explanation

Why old inflation theory no longer fits the post 2008 world and how debt, policy, and institutional choices decide who absorbs the loss when prices jump.

Britain’s Economy Is Not Broken. It Is Being Quietly Mismanaged

A systems diagnosis of how administrative comfort replaced genuine correction and why apparent stability can mask long term wealth erosion.

Liberation Day: Trump’s Tariffs and the Cost of Living

How tariffs function as a regressive import tax, why consumers pay, and how trade policy becomes domestic price pressure in disguise.

The Frozen Assets Dilemma: Why the City of London Is Warning Against Using Russia’s Frozen Money

A financial and legal risk review of turning immobilised sovereign assets into policy tools and what that does to trust in custody.

When As Safe as the Bank of England Stops Being True

A model of the trust haircut problem: what happens to a country’s exported credibility when institutions are seen as tools rather than neutral custodians.

Germany De Industrialised, Britain Broken: The Real Cost of the Ukraine Gamble

An economic consequences analysis of energy, industry, and policy tradeoffs that reshaped Europe’s cost base and long term competitiveness.